Having said that, various nations have varying standards for what constitutes broad

money and narrow money. The meanings vary depending on the context in which we use the term. However, we might also use it when referring to just to the least liquid forms of money. Different countries define their measurements of money in slightly different ways.

To date, MFS data are obtainable only from December 2016 to May 2021 on a monthly basis from Bangladesh Bank [24]. For our analysis, we need data of narrow money, broad money, monetary base and MFS transactions all in a coherent manner, i.e., we need to truncate the longer series to the extent of the shorter ones. The common time span amongst which all these data series are available is from January 2018 to January 2021, i.e., we have 37 (thirty seven) months of data at hand to carry out our empirical analysis. The selected time span also coincidentally reflects a period of remarkable growth of mobile financial services in Bangladesh.

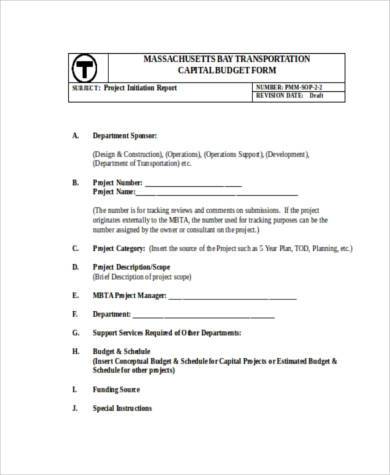

Board of Governors of the Federal Reserve System

However, in spite of these short positive spikes, annual contributions of MFS transactions on currency outside bank are overly negative, i.e., cash currencies are entering into the banking channel and the corresponding data are shown on the right hand side of Fig 2. We have seen a declining annual trend in the value of changes in currency outside bank originating from MFS transactions. When the Fed conducts QE with primary dealer banks it purchases US-treasuries from them, and in return it credits their bank accounts held at the Fed with additional bank reserves.

- Broad Money refers to the total amount of money held by individuals and companies within an economy.

- Very recently, such regulatory capping of interest rate was carried out in Kenya [40] and the results of this initiative were not very promising.

- According to a consumer behavior survey conducted in association with UN Capital Development Fund (UNCDF), it is observed that around 30% of the micro-merchants in Bangladesh tend to use mobile financial services to conduct their business [8] which indeed is quite an achievement.

- The selected time span also coincidentally reflects a period of remarkable growth of mobile financial services in Bangladesh.

We also calculate the annual changes in currency outside bank by the formula stated in column 4 of the last row of Table 3. The estimated values of changes in currency outside bank both in monthly and annual basis are illustrated in Fig 2. These short spikes indicate outflow of currency from banking system (through the TCSA accounts) to public.

Discussion and policy implication

Broad Money is an important term in business and finance as it represents the largest measurement of the money supply within an economy. This encompasses not only physical money such as notes and coins, but also highly liquid financial instruments including saving accounts, money market instruments, and other time deposits. Changes in the Broad Money supply can indicate general economic trends or the possible direction of monetary policy. An increase in Broad Money can suggest an economy in growth mode, while a decrease may imply economic slowdown. Therefore, a comprehensive understanding of Broad Money is crucial for policy-makers, economists, and investors. Broad money serves as one of the key economic indicators to get a comprehensive view of an economy’s financial condition and the level of money supply.

Narrow money supply, also known as M1, refers to the total amount of physical currency in circulation in an economy, along with demand deposits held by commercial banks and other financial institutions. It includes all the liquid assets that can be used as a medium of exchange, such as cash and checking account balances. Broad money is a type of money that encompasses narrow money and other items that

may readily be turned into cash such as international currencies, certificates of deposit,

money market accounts, treasury bills, and marketable securities. On the other hand, narrow money covers

various forms of physical money, such as cash, liquid assets maintained by the central

bank, demand deposits, and coins, in its definition of money provided. However, Bangladesh currently allows only a bank-led MFS model whereby a bank operates MFS services as a product or it may form a subsidiary to do so holding at least 51% of the voting shares of the subsidiary thus formed [14].

Some preliminary definitions

It could be argued that by increasing their reserves, banks would be further incentivised to grant more loans in the economy, thus increasing broad money supply, and stimulating economic activity. However, in many financial markets the constraint on additional bank lending has not been a shortage of bank reserves (particularly in markets like the USA, which have a 0% reserve requirement). So, it can be concluded that QE with primary dealer banks would have a limited effect on broad money supply. As new money has entered into the banking system through MFS, they (this newly entered money) will then be amplified inside the bank according to the theory of fractional reserve banking. We will gauge the extent of narrow money and broad money created by this newly entered money.

M2 includes all the items in M1, plus deposits redeemable at notice of up to three months and deposits with an agreed maturity of up to two years. The European Central Bank provides three measures of money – M1, M2, and M3, where M1 is the narrowest and M3 the broadest. The Federal Reserve in the United States provides two main measures of money – M1 and M2, where M1 is the narrowest and M2 the broadest.

Broad money refers to the total money supply in an economy, including cash, checking accounts, and savings accounts. In simple terms, if there is more money available, the economy tends to accelerate because businesses have easy access to financing. If there is less money in the system, the economy slows and prices may drop or stall.

Definitions of Money in Europe

As the home loan is repaid, the broad money supply in the economy would gradually be reduced. The base money supply would have stayed the same as no new reserves would have been created, only transferred from the buyer’s bank to the seller’s bank. A home buyer’s bank would approve a home loan application from the home buyer.

- An obvious consequence of the enhancement of money supply is the reduction of interest rate as interest rate is simply the cost of borrowing money.

- Moreover, OECD database does not report Bangladeshi monetary data [20].

- Furthermore, no primary dealer bank would lend reserves to another primary dealer bank at a rate below 0.15%, when they could just leave their reserves on deposit with the Fed and earn 0.15%.

- Meanwhile, the monthly and annual changes in broad money brought about by the MFS transactions are calculated using the formulas presented at column 6 of the last row of Tables Tables22 and and33 respectively and the results are demonstrated in Fig 4.

- Thus, the economic costs of interest rate capping were heavy in Kenya while the benefits were not so impressive as anticipated.

It means any significant fluctuations in broad money can be an early warning sign of economic changes like inflation, recession, or economic growth.On a practical level, broad money aids businesses in making financial decisions based on prevailing economic conditions. This term is widely used in different sectors like banking, investment, and finance broad money refers to for risk management, setting investment strategies, and financial planning. For instance, if there is a growth in broad money levels without corresponding growth in output, it can be a signal for businesses that there may be inflation in the future. It helps businesses and investors to prepare in advance and adjust their strategies accordingly.

To measure the monthly and annual changes in narrow money brought about by the MFS transactions, we will use the formulas presented at column 5 of the last row of Tables Tables22 and and33 respectively. From the left hand side of Fig 3, we can see that the monthly changes in narrow money are roughly positive throughout the period under investigation with a few negative prongs. In spite of having a few negative prongs, the annual changes in narrow money, estimated by the formula presented on column 5 at the last row of Table 3, are mostly positive and these results are depicted on the right hand side of Fig 3. The right segment of Fig 3 demonstrates that during 2018, 2019 and 2020, approximately BDT 19,118.22, 11,463.70 and 5,141.14 crore of narrow money has been created by the mobile transactions. These newly created narrow monies comprise 5.82%, 3.49% and 1.57% of the total narrow money in circulation as on January 2021. Again, a declining trend is noticed in the amount of newly created narrow money.

This would typically indicate a credit quality problem with the bank experiencing a deficit in reserves. For these reasons, the Fed’s discount rate would be set at a rate higher than the interbank lending rate. The interbank lending rate is referred to as the “Federal Funds Rate”, and is set at a target rate by the Fed periodically. The Federal Funds Rate affects the rates at which banks are able to raise short-term capital from one another, and is therefore an important benchmark used in the pricing of all other rates of all financial instruments in the economy. By controlling the Federal Funds Rate, the Fed can effectively control all other rates in the economy. In aggregate, the broad money supply in the economy increased by the value of the new home loan.

Hence, when QE is performed with non-banking firms, additional broad money would be created. If the Fed wished to perform QE with non-banking firms it would need to do so by using its primary dealers as intermediaries. The non-banking firms would sell their government treasuries to the primary dealer banks, who would simultaneously sell them to the Fed. The primary dealer banks would then receive additional bank reserves from the Fed as payment (deposited into their Fed bank accounts). Finally, the primary dealer banks would pay the non-banking firms by crediting their bank accounts with additional cash deposits.

Broad money

Also, an understanding of broad money can be crucial in making key investment decisions, as it gives investors an idea of the total funds circulating in the economy. Therefore, broad money serves a significant role in macroeconomic management as well as in business and financial decision-making processes. Broad Money and Narrow Money are two measures of money supply used in economics to capture the different forms of money in an economy. Broad money refers to the total amount of money in circulation, including cash and bank deposits, while narrow money only includes the most liquid forms of money, such as cash and highly liquid bank deposits. These measures are important in analysing the overall health of an economy and for understanding the effectiveness of monetary policy.

Since these reserves cannot be spent in the economy, no additional broad money is created in the economy when QE is performed with banks. Broad Money refers to the total amount of money held by individuals and companies within an economy. It includes coins, bank notes, money market accounts, savings, checking, and time deposits. Broad money is a measurement of the total amount of money held by households and companies in the economy. It includes notes and coins, bank deposits, short-term bonds, and other highly liquid assets.

What Is Deflation? - Kiplinger's Personal Finance

What Is Deflation?.

Posted: Sun, 06 Aug 2023 14:00:21 GMT [source]

Near money is a component of broad money that can be quickly and easily converted into cash. If your institution or institutions have a press office, please let them know about your upcoming paper now to help maximize its impact. If they'll be preparing press materials, please inform our press team within the next 48 hours. Your manuscript will remain under strict press embargo until 2 pm Eastern Time on the date of publication. I'm pleased to inform you that your manuscript has been deemed suitable for publication in PLOS ONE. PLOS authors have the option to publish the peer review history of their article (what does this mean?).